Implementation Guidelines for Service Provider in Onboarding

This comprehensive factsheet serves as your primary guide for a successful integration with the bLink platform. It consolidates essential resources, tools, documentation, and critical considerations for seamless implementation. Additionally, it provides insights into common questions and lessons learned from previous participants. This guideline is tailored for the implementation of AIS and PSS APIs. Use this resource to prepare, execute, and optimize your integration, maximizing the value of your bLink platform experience.

Resources and Tools

Use the links and tools below to start your bLink integration.

Required resources for Implementation

- bLink Support Portal

- bLink Docs

- bLink Service User Simulator XE( Account must be requested via Support Portal)

- bLink Service User Simulator XP( Account must be requested via Support Portal)

- bLink Service Provider Simulator (Postman collection for Service User implementation, relevant if Service Providers also act as Service Users)

AIS / PSS APIs and Swiss Payment Standards

bLink APIs adhere to Swiss Payment Standards guidelines for:

OpenWealth APIs

bLink APIs adhere to the standards defined by the OpenWealth Association:

Registration Requirements for Connectivity

To establish a connection to bLink’s testing environment:

- Study the Registration & Connectivity Section in bLink Docs

- Complete the Connectivity File for Service Provider for participant registration

- General participant information

- Network information

- API endpoint URLs

- Full chain client and server certificates in

.pemformat to establish mutual TLS (mTLS) connections (Requirements documented in bLink Docs)

Note: SIX provides their client certificates, which must be registered in the provider’s trust store.

Key API Implementation Considerations

Apply these baseline rules to keep your implementation compliant, consistent, and operationally smooth.

Field Inclusion

While API specifications differentiate between required and optional fields, optional fields must be included whenever relevant information is available. These fields are defined as optional only because they may not apply universally.

Full Endpoint Support

Implement all AIS and PSS endpoints (both in JSON and XML format) to ensure full functionality and seamless interaction with all consumers.

Data Consistency

Ensure that all IDs (e.g., account identifiers) allocated through the APIs remain consistent across all tokens and consents used to access the data. This consistency ensures reliable data handling and consumer interactions.

Error Handling

Implement error responses per bLink specifications.

Use the commonErrorResponse structure: {type, title, detail, instance}.

API Version Management

New AIS and PSS API versions are released in November in alignment with Swiss-Payment-Standards (SPS) release cycles (Details are documented in bRelease Management Process). Maintain parallel versioning to ensure continuity during transitions.

Token Validation

For invalid or expired tokens, respond with 401 Unauthorized, include a relevant problem definition, and the WWW-Authenticate response header according to RFC6750.

Platform Module

Use the resources and requirements below to use the platform module in accordance with bLink’s specification:

- Link to API Specification

- Link to bLink Doc - API Reference

- Synchronize the directory of clients at least once a day, as updates will occur regularly.

- Participant IDs include an environment identifier: test (X) or production (P) and follow these structures:

- Service Provider:

IID{X/P}01234(Always includes bank clearing number as suffix) - Service User:

CID{X/P}0123456789(Environment-specific suffix)

- Service Provider:

Consent Flow Module

Use the resources and requirements below to implement the consent flow in accordance with bLink’s Consent Specification.

Resources

- Link to API Specification

- Link to bLink Doc - Consent Management

- Link to bLink Doc - API Reference

- Link to bLink Doc - Token Management

Functional Requirements and Recommendations

- Dynamic authorization of Service Users is mandatory.

- Access to new Service Users must be granted at Go-Live

- Consents are granted according to the scopes included in the authorization request. The Service Provider may let the user refine the consent by use case (scope), account relationships or by selecting individual accounts.

- Facilitate overarching consent for all accounts within the user's e-banking contract.

- Allow users to manage consent for all accounts within their e-banking contract by using multiple tokens. Each token can represent a specific account or group of accounts.

- Enable users to edit existing consents and handle account changes automatically.

- Support self-service integration without requiring bank intervention.

Technical Requirements

- Validate requested scopes and verify that the SU is authorized to request them.

- Return

error=invalid_scopefor unsupported scopes. - Run all consent flow tests in the SU Simulator’s Automated Testing section to verify compliance with the Consent Specification.

- Ensure tokens adhere to defined lifetimes

Account Information Service

Use the resources and requirements below to implement the AIS API to ensure a reliable service and a good user experience.

Resources

- Link to API Specification

- Link to bLink Doc - AIS Guide

- Link to bLink Doc - API Reference

- Swiss Payment Standards - Cash Management (Latest Version must be considered)

Functional Requirements

- Provide historical data (24 months) at initial consent in at least one format (JSON or XML).

- Offer intraday data for

/balanceand/transactionsendpoints. - Include multiple updates for booked transactions and balances during the day.

Technical & Content Requirements

JSON

- While API specifications differentiate between required and optional fields, optional fields must be included whenever relevant information is available. These fields are defined as optional only because they may not apply universally.

- Carefully review all descriptions and definitions in the API specifications, including attribute mapping to the SPS Guidelines.

- Additional resource: Refer to the Factsheet in the SFTI GitHub for clarification on

/transactionendpoint behavior.

XML

- Schema: Use the

camt.053.001.08.xsdschema exclusively.- Populate "IBAN", "dateFrom", and "dateTo" as per AIS v5 conditions.

- Multiple Retrievals: Enable statements to be retrieved multiple times, per User, across Service Users or consent sessions.

- Timing: Reflect data from the user's consent date onward (or earlier for backward statements).

- Important Note: Several banks offer XML statements through existing channels with user-specific configurations. For the purpose and use of the bLink Account & Payment Service, these settings must be reset and reconfigured to comply with the platform requirements:

- Existing Configurations do not apply: User settings for other services must not affect bLink.

- Batch Booking Breakdown: Ignore external batch-booking breakdown instructions in

camt.054, and deliver details incamt.053. - Full Transaction Details: Always deliver detailed (d-level) transaction information.

- Immediate Availability: Statements must be ready as soon as possible, once the user connects via bLink.

- Backward Compatibility: Where feasible, generate historical statements for pre-onboarding periods.

- Double Pickup: Ensure that a statement remains available for multiple retrievals.

Payment Submission Service

Use the resources and requirements below to implement the PSS API to ensure a reliable service and a good user experience.

Resources

- Link to API Specification

- Link to bLink Doc - PSS Guide

- Link to bLink Doc - API Reference

- Swiss Payment Standards - Credit Transfer (Latest Version must be considered)

- Swiss Payment Standards - Status Report (Latest Version must be considered)

Functional Requirements

- Align payment processing with e-banking processes to ensure consistency in the user experience.

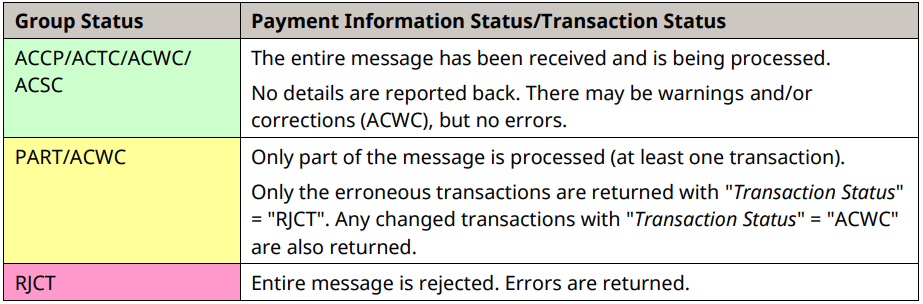

- Reflect accurate payment statuses (

ACCP,PART,RJCT) based on SPS guidelines.

- Payments with status

ACWC - Accepted with Changemust not be rejected. Uses must perform corrections directly in e-Banking. - Payments with status

PART - Partially Acceptedmust process only the accepted payments. - Assign a unique submissionId for each payment and include it with a relative path in the

locationheader and in the body of the response.

XML

- bLink Supports xsd schema

pain.001.001.09.ch.03.xsdandpain.002.001.10.xsd

Additional Notes for Successful Integration

- Regularly consult the bLink Docs and Blog Posts for updates to the API specifications.

- Use the automated testing feature of the simulator to check the progress and compliance of your implementations.

- Either XE or XP environment can be used for testing and verification depending on the participant's preferences.

- Follow bLink’s API release management and monitor the SFTI GitHub Repository to be prepared for upcoming changes.

- Actively contribute to the SFTI community meetings to help further develop the API specifications with the community.