Introduction to the bLink Platform

bLink is the Swiss open banking platform developed by SIX, providing efficient and secure connections between banks and fintechs through standardized APIs. On behalf of and with the explicit permission of their mutual customers, platform participants exchange various types of financial data (e.g., payment account data or wealth data) to enable new products, services and user experiences, while fostering innovation and collaboration within the Swiss financial services industry. With a high degree of standardization, bLink creates all the prerequisites for banks and fintechs to form successful partnerships in the context of open banking:

- A uniform platform contract and admission test instead of individual agreements and due diligence processes ensure efficiency, security and trust

- A fully digital consent flow and management ensures complete control and transparency for end customers

- Modern, standardized and industry-backed interfaces in the areas of Accounts & Payments and Wealth Management (OpenWealth) ensure the highest reliability and potential for innovative use cases

Banks and fintechs not only profit from bLink's complete legal set-up and technology infrastructure, but they can also make use of a centralized partner management, in which SIX ensures the standardized onboarding and support of all participants.

Participants

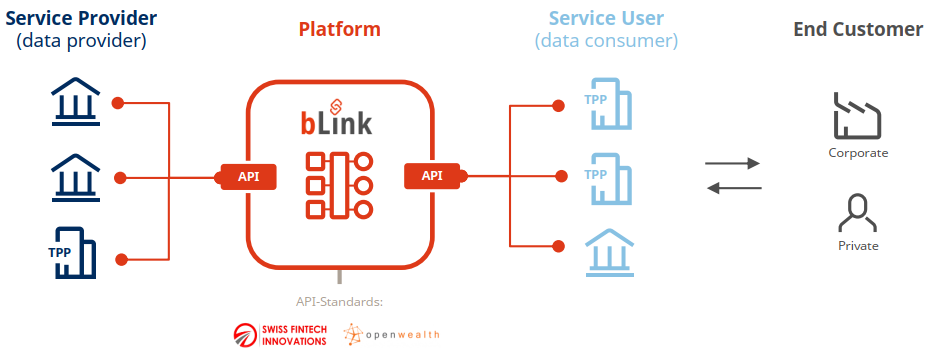

Apart from the platform itself, three main roles compose the bLink ecosystem: Service Providers, Service Users and End Customers:

Service Users, usually fintechs but also banks themselves (e.g., multibanking), are providers of software applications that integrate consent-driven banking data on behalf of their end customers into their solutions. Through bLink, applications can connect and integrate multiple banking data providers (Service Providers, see below) simultaneously.

Service Providers, typically banks or other financial institutions, enable their customers to connect their bank accounts to Service User software applications of their choice to enhance existing services or create entirely new ones.

End Customers are mutual individual or corporation customers of the Service Provider and the Service User that rely on easy access to their financial data within the Service User’s application. Thanks to the consent flow and management on bLink, they always have full control and transparency over who uses their banking data and for what purpose. This also includes the option of disconnecting their accounts from a specific Service User anytime.

To find out more about bLink and how it works, check out our FAQ section on the official bLink website.

How to onboard

Find out more information on how to kick off with our open banking platform in the chapter Start with bLink.